Unlocking the Potential of Auto Forex Trading

In the world of finance, the foreign exchange market is one of the most dynamic and accessible. As technology evolves, so do trading methods. One of the most significant innovations in recent years is auto forex trading, a method that automates the trading process, allowing both novice and experienced traders to capitalize on market fluctuations without constant monitoring. For those looking to delve deeper into this exciting world, resources like auto forex trading https://fxtrading-broker.com/ can provide valuable insights and tools for success.

What is Auto Forex Trading?

Auto forex trading, also known as automated trading or algorithmic trading, involves using computer programs and algorithms to execute trades based on predefined criteria. This method allows traders to set specific parameters for buying and selling currencies, freeing up their time while still participating in the forex market.

How Auto Forex Trading Works

The core of auto forex trading lies in trading algorithms, often referred to as trading bots. These programs can analyze market data, identify trading opportunities, and execute trades automatically. Here’s a breakdown of how the process typically works:

- Signal Generation: The algorithm analyzes market trends and signals based on historical price data and technical indicators.

- Trade Execution: Once the algorithm identifies a profitable trade setup, it can execute the order based on the trader’s specifications.

- Risk Management: Automated trading features often include robust risk management tools, allowing traders to set stop-loss orders and manage their exposure to losses.

Benefits of Auto Forex Trading

Auto forex trading offers several advantages, making it appealing for traders of all experience levels. Here are some key benefits:

1. Emotion Control

One of the most significant challenges in trading is managing emotions. Fear and greed can lead to impulsive decisions that jeopardize profits. Automated trading eliminates emotional interference, as all trades are executed based on logic and pre-set conditions.

2. Time Efficiency

Manual trading requires constant monitoring of the markets, which can be time-consuming. Auto trading frees up time for traders, allowing them to engage in other activities while their trading strategy works in the background.

3. Backtesting Capabilities

Before deploying an algorithm, traders can backtest their strategies using historical data. This process helps in assessing the viability of a strategy, minimizing the risk associated with real-time trading.

4. 24/7 Market Access

The forex market operates 24 hours a day, five days a week. Automated trading systems can function around the clock, ensuring that traders can seize opportunities at any time, even when they are not actively involved.

Challenges and Considerations

While auto forex trading has its benefits, it also presents certain challenges and considerations that traders should be aware of:

1. Technical Failures

Relying on automated systems means trusting technology. Technical glitches, internet outages, or power failures can hinder trading activities and lead to unexpected losses.

2. Strategy Dependence

The success of automated trading relies heavily on the quality of the trading algorithm. A poorly designed strategy could lead to significant losses. Continuous optimization and adjustment are necessary to adapt to changing market conditions.

3. Over-Optimization

Traders may fall into the trap of over-optimizing their strategies based on historical data, leading to overfitting. This can result in a strategy that performs well in backtesting but fails in real market conditions.

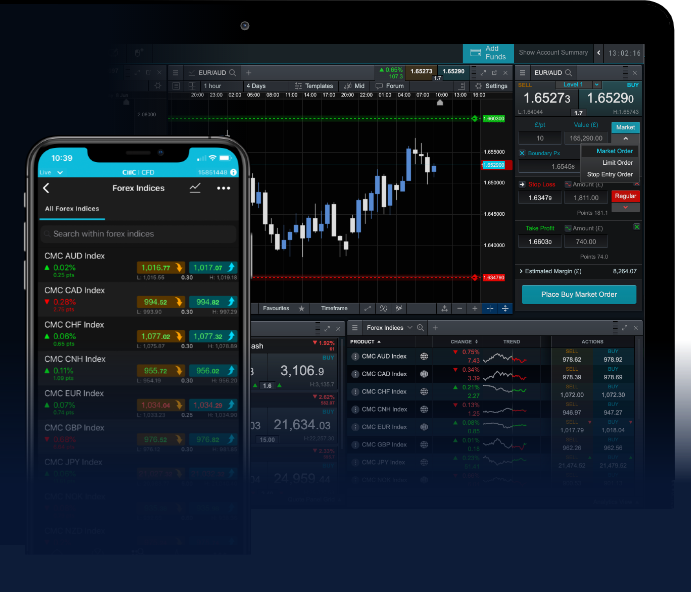

Choosing the Right Auto Forex Trading Platform

Selecting a reliable and effective auto forex trading platform is crucial for success. Here are factors to consider when evaluating platforms:

- User-friendly Interface: The platform should be easy to navigate, with a clear layout and accessible features.

- Security Measures: Ensure that the platform employs robust security protocols to protect your data and funds.

- Algorithm Customization: Look for platforms that allow you to customize and create your own trading algorithms.

- Customer Support: Efficient customer support can be a lifesaver, especially when technical issues arise.

Final Thoughts

Auto forex trading presents a unique opportunity for traders to engage in the forex market with enhanced efficiency and reduced emotional stress. While it is not without its challenges, proper knowledge and tools can lead to successful trading outcomes. Continuous learning and adaptation are essential, as is selecting a platform that meets your trading needs. Explore the exciting possibilities of automated trading, and take your forex journey to the next level!